Financing Energy Generation

Finance And Energy

Conversation With Chat GPT4 27 March 2024

Articles Series: Energy

Financing Energy Generation Artwork

F McCullough Copyright 2024 ©

Financing Energy Generation

Challenges And Perspectives

Financing energy generation projects is a critical component of the global transition towards more sustainable and reliable energy systems. However, this endeavour faces numerous challenges, from securing initial capital to ensuring long-term profitability and sustainability. This discussion will explore the multifaceted issues surrounding the financing of energy generation, offering insights into current dilemmas and potential strategies for overcoming them.

Initial Capital And Investment Risk

One of the primary challenges in financing energy generation projects is the significant initial capital requirement, particularly for renewable energy sources such as wind, solar, and hydroelectric power.

High Upfront Costs

Renewable Energy Projects: These often require substantial upfront investments for infrastructure development, including procurement of land, technology, and equipment.

Fossil Fuel Projects: While also capital-intensive, they are traditionally backed by more established financial models and revenue forecasts.

Investment Risks

Market Fluctuations: Energy prices can be highly volatile, affecting the profitability of energy projects.

Technological Risks: Investments in newer or less proven technologies carry higher risks due to potential technical challenges, or faster-than-anticipated obsolescence.

Access To Financing

The ability to access financing, varies significantly across regions and types of energy projects, influencing the pace and scope of energy generation expansion.

Developing Versus Developed Countries

Developed Countries: Typically have better access to financing through more mature financial markets and institutions, as well as government support.

Developing Countries: Often face challenges in attracting investment due to political instability, economic volatility, and less developed financial sectors.

Public Versus Private Financing

Public Financing: Government funding and subsidies play a crucial role in supporting energy projects, especially renewables. However, these are often limited by budget constraints.

Private Financing: While private investment is essential for scaling up energy generation, it is frequently deterred by perceived risks, and the investorís pursuit of higher returns elsewhere.

Regulatory And Policy Uncertainty

Government policies and regulatory frameworks greatly influence the financial viability of energy projects, with changes posing a significant risk to investors and financiers.

Policy Inconsistency

Frequent shifts in energy policy can disrupt project planning and execution, impacting long-term investment decisions.

Uncertainty in subsidies, tax incentives, and regulatory approvals can deter investment in renewable energy projects.

International Agreements And Commitments

Global agreements on climate change and sustainability goals can shape national energy policies, affecting the financial landscape for energy generation.

Technological Advancement And Cost Reduction

The rapidly evolving nature of energy technologies presents both challenges and opportunities for financing energy generation.

Decreasing Costs Of Renewables

The costs of renewable energy technologies, particularly solar and wind, have decreased significantly, making them more competitive with traditional energy sources.

Despite reduced costs, the initial investment required remains a barrier for widespread adoption without supportive financing mechanisms.

Need For Innovation In Financing Models

New financial instruments and models, such as green bonds, Yield Companies (Yieldcos, A company that owns operating assets with predictable cash flow, perhaps by long term contracts), and crowdfunding, are emerging to bridge the funding gap for energy projects.

These innovative financing solutions aim to reduce risk and attract a broader range of investors to the energy sector.

Summary

Financing energy generation encompasses a complex array of challenges, from high initial costs and investment risks to regulatory uncertainty and the need for innovative financing models. Overcoming these challenges requires a concerted effort from governments, the private sector, and international entities to create a stable, supportive financial environment that encourages investment in sustainable and efficient energy generation. As the world continues to demand more energy, finding solutions to these financing dilemmas will be crucial for ensuring a sustainable energy future.

Key Takeaways

Addressing the financing challenges for energy generation is pivotal for advancing global efforts towards sustainable and reliable energy systems, necessitating innovative approaches and cooperation across public and private sectors to secure the necessary investments.

Conversation with Open AIís ChatGPT4 Reviewed, Revised and Edited by F McCullough, Copyright 2024 ©

Thought Of The Day

True leadership in energy

means meeting the demands of

today

and

foreseeing and shaping the

possibilities of tomorrow.

Possibilities Of Tomorrow Artwork

F McCullough

Copyright 2024 ©

Artwork

Financial Generation Artwork

F McCullough Copyright 2024 ©

Theme Art

Finance Sustainable Energy Artwork

AI Generated Image From Dall-E 2024 Theme Art, Edited And Adapted by F McCullough 2024

This illustrated image, aims to capture the essence of collaborative efforts required to finance sustainable energy generation. This visual metaphor brings together various stakeholders around a glowing globe, symbolising the unity and diversity of efforts needed to overcome the financial challenges in creating a sustainable energy future. Each participant contributes a piece to the puzzle, representing different financing models and renewable energy sources, highlighting the importance of collective action in achieving energy sustainability.

Open AIís ChatGPT4 Reviewed, Revised and Edited by F McCullough. 2024

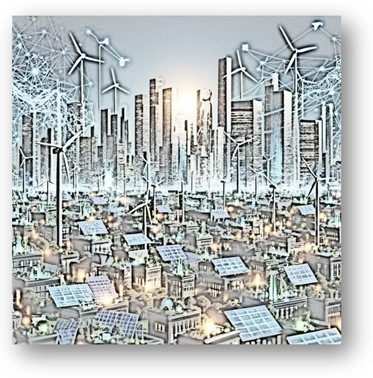

Innovative Financing In Energy Generation Artwork

AI Generated Image From Dall-E 2024 Theme Art, Edited And Adapted by F McCullough 2024

This illustration vividly portrays a futuristic cityscape, a testament to the successful outcome of innovative financing in energy generation. This vibrant scene is a mosaic of sustainability and efficiency, showcasing a world where financial hurdles in the path of sustainable energy have been surmounted. Solar panels, wind turbines, and green buildings dot the skyline and are also seamlessly integrated, symbolising a thriving urban environment fuelled by sustainable investments.

Open AIís ChatGPT4 Reviewed, Revised and Edited by F McCullough. 2024

Links

Agriculture

Articles

Artificial Intelligence

Business

Ecology

Education

Energy

Finance

Genomics

Goats

Health

History

Leadership

Marketing

Medicine

Museums

Photographs & Art Works

Artworks, Design & Photographs Index

Other Photographs & Art Works By F McCullough

Places To Visit

Other Museums And Places To Visit

Plants

Poetry

Research

Science & Space

Science & Space Articles & Conversations

Short Stories

Songs

Technology

Information

Image Citations

- Financing Energy Generation Artwork F McCullough Copyright 2024 ©

- Possibilities Of Tomorrow Artwork F McCullough Copyright 2024 ©

- Financial Generation Artwork F McCullough Copyright 2024 ©

- Finance Sustainable Energy Artwork Adapted And Edited From An AI Generated Image by F McCullough 2024

- Innovative Financing In Energy Generation Artwork Adapted And Edited From An AI Generated Image by F McCullough 2024

Table Of Contents

Initial

Capital And Investment Risk

Developing

Versus Developed Countries

Public Versus

Private Financing

Regulatory

And Policy Uncertainty

International

Agreements And Commitments

Technological

Advancement And Cost Reduction

Decreasing

Costs Of Renewables

Need For

Innovation In Financing Models

Copyright

Keywords: adaptive leadership,

artificial intelligence, bioenergy, carbon capture and storage, circular

economy, clean energy transition, climate change, data analytics, digital

transformation, energy efficiency, energy storage, environmental stewardship,

ethical leadership, global energy markets, innovation, leadership skills,

renewable energy, smart technologies, stakeholder engagement, sustainability,

technological disruption, waste-to-energy, wind and solar power,

Hashtags: #adaptiveleadership,

#artificialintelligence, #bioenergy, #carboncaptureandstorage,

#circulareconomy, #cleanenergytransition, #climatechange, #dataanalytics,

#digitaltransformation, #energyefficiency, #energystorage,

#environmentalstewardship, #ethicalleadership, #globalenergymarkets,

#innovation, #leadershipskills, #renewableenergy, #smarttechnologies,

#stakeholderengagement, #sustainability, #technologicaldisruption,

#wastetoenergy, #windandsolarpower

Created: 27 March 2024

Published: 27 March 2024

Page URL: https://www.mylapshop.com/financingenergygeneration.htm